Mr. Obama was elected partly because of his often-repeated promise not to raise taxes on anyone making

less than $250,000 per year. Anyone who had investigated Mr. Obama's background would have known

immediately that his promise wouldn't last long after his inauguration. We are now experiencing

Obama's third term. Nothing has improved; indeed since Obama is hiding behind Biden (who in turn

does as he is told), there's no reason to worry about voters' objections. Print money!

That's the Socialist Democrat party platform now.

Reverse

Pyramid Scheme: Average Annual State Budget Is 37% Federal Money. An alleged

bulwark against the fifty states overspending like the federal government? Has been the old

saw: "The states can't print money." Another alleged bulwark? 49 of the 50 states

have some sort of self-imposed balanced budget requirement. From Grok: "49 US states have

some form of balanced budget requirement, which mandates that their operating budgets (excluding

capital and pension funds) cannot run a deficit. "These requirements vary in strength — some

are constitutional and prohibit carrying over deficits, while others are statutory and allow more

flexibility — but all but one state enforce them at stages like proposal, passage, or enactment.

"The exception is Vermont...." And yet without exception? Every state is in debt.

'How's

the Economy?' — It's Harder Than Ever To Say. The problem is, it's an

amazingly subjective question, because there can really be no single definition of "the

economy." There is one's personal view of the economy — your own job or job

search — and if you're a head of household, then there's your job, your spouse's job,

your children's jobs, and the perceived potential or trends going forward in all of your

careers. Is the career you chose for your specialty a career with growing or shrinking

opportunities in the foreseeable future? Then there is one's view of the local

economy — "I'm doing fine — lucky for me — but my town lost a

major plant, or the factory relocated to China or Mexico, or the coal mine or oil field or gas

clothes dryer factory or lightbulb factory was shut down by the EPA" — and that

situation rightly affects your view of the economy in general. There's a huge difference in

whether one is in a red state, a blue state, or a swing state. Florida and Texas are healthy

economies, for example; California and Illinois are on life support due to the choices of decades

of bad governors and state legislatures.

Economic

blackouts and economic illiteracy. Only in the world's richest country —

with the deepest capital markets, the most studied institutions, and the broadest consumer

choice — could tens of millions of people persuade themselves that refusing to buy a cup

of coffee for 24 hours constitutes a coherent form of economic protest. These

choreographed "blackouts" and "no-shop days" are not movements, they are tantrums. Worse,

they are tantrums rooted in a catastrophic misunderstanding of what causes prices to rise, how

markets function, and what actually drives improvements in living standards. The central

fiction animating these protests is the idea that prices are set by a shadowy cabal of greedy

firms, and that abstaining from consumption — moreover, briefly and often

symbolically — will somehow teach businesses a lesson. It's a risible, comic-book

conception. [...] At the heart of these protests sits the ever-popular but completely backward

belief that profits cause high prices. This reverses cause and effect. Profits

are the result of delivering value to consumers; they are the signal that resources are being used

efficiently. Remove profits and you remove the incentive to innovate, to take risks, to

expand supply, to lower costs, and to differentiate.

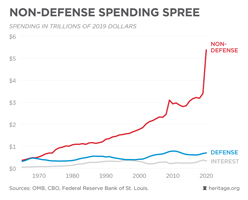

We're

Living In A Dream World. Since 2013, there have been only five formal budgets passed

by Congress. Everything else has been a continuing resolution, maintaining status quo

spending without debate on budgetary priorities. In so doing, Congress has abrogated its

greatest power and duty. There is no budgetary process. No one is truly guiding the

nation fiscally. The idea of a representative Congress setting funding priorities reflective

of America's wishes, is pure dream fantasy.

Reality On SNAP (And Everything

'Discretionary'). I don't care what some judge ruled; said judge has no jurisdiction

as the Constitution is clear, thus said ruling is void. Worse, that ruling demands that a

criminal statute (the anti-deficiency act) be violated. [...] The Trump Administration must refuse

and Congress must impeach this judge. Why? Because the Constitution mandates that no

funds may be spent without an appropriation and all appropriations expire on September 30th

when the fiscal year ends. Each and every year Congress appropriates money for SNAP/EBT (and

a [lot] of other stuff); they could (as they did with Medicare and Social Security) remove that

from annual appropriations but they didn't. It does not matter if there is an "emergency" or

"contingency" fund; on September 30th all unspent funds are unavailable as they are

effectively escheated back to Treasury. This is the black letter of the Constitution and no

judge can change that; only a Constitutional Amendment can change it.

Black

Elites Keep Flogging the Victimhood Lie. Progressivism is a house of cards built

precariously on a foundation of sand. It hinges entirely on demonstrably false narratives

intentionally designed to sow division and to "rub raw the resentments of the people," as

Luciferian Left-wing strategist Saul Alinsky put it. One of those narratives is that America

was founded as, and continues to be, a systemically racist, white supremacist nation in which the

purported "Land of Opportunity" excludes the awkwardly termed "people of color" from its promises

and prosperity. [...] Multi-millionaire political commentator and former MSNBC host Joy Reid too

has built a career on the assertion that, "Yes, this is a racist country," a claim she believes is

proven because "racial disparity" exists. During a recent BET Talks interview, she

fear-mongered that "we are in a fascist moment," one in which her Republican opponents want to take

us back to "a right-wing, White nationalist, White supremacist moment that is centered around

hierarchy." Her evidence is that Republicans are contemplating doing away with income

tax. She believes this is fascist — even though fascism is all about state power,

and abolishing income tax would reduce that — and racist — even though blacks

too would not owe income tax.

Tariffs

are not taxes. Democrat lawyers want to define tariffs as taxes because taxes must be

approved by Congress, not Trump. Taxes are imposed upon persons earning income in the U.S.

Tariffs are import duties imposed upon foreign entities. They are not taxes. The courts

need to get this right. If the courts says Congress must approve tariffs, Congress will be

unable to comply. Tariffs change commonly, and there are 194 countries that will pay

tariffs to us. There is no chance that Congress could handle that task, nor should it.

Congress's duty is to approve a rare change of income tax, which is a single tax, not 194 different

income taxes. Democrats might argue that tariffs cause inflation. Despite high tariffs,

the most recent monthly inflation rate was only 0.2 percent. That is a 2.4-percent

annualized rate, nearly what it was before Biden ran the annualized inflation rate up to 9.6.

Illegal

Deficit In the Budget? Raise Property Taxes! Forsyth County, North Carolina has

decided to raise property tax values by an enormous amount, which is not surprising for a county

controlled by Democrats and RINOS. One property owner told me that his 36-year-old

1,600-square-foot house, which was formerly appraised at $125,500, was just re-appraised at

$242,600; this is a 93.3% increase in property tax value. (The median home value in Forsyth

County is $163,426, which is already 25% higher than the national median value of $130,626.)

This homeowner appealed this increase in February of 2025, as he thought this level of increase was

absurd. His new appraisal showed 0% for economic depreciation and 0% for functional

depreciation, yet he received the new bill with the enormously high property tax value the first of

August. Contacting the tax office, they said they had no record of his appeal, and he was

patched through to a lead tax deferment specialist with twenty years of experience, who on two

separate occasions stated that just because the appeal was not scanned into the system does not

mean that they do not have it. So, the homeowner asked if he could send a copy of the appeal

to the specialist so that it could be put into the system. Upon doing this, he promptly

received a telephone call stating that his appeal had been deemed "untimely" and the July 7,

2025 newly appointed tax assessor stated that all appeals had been scanned into the system, and the

20-year tax specialist was in error. This homeowner is still fighting.

Say,

Whatever Happened To All Those Devastating Spending Cuts We Were Warned About? [T]he

latest monthly Treasury Department report last week [...] showed that the July deficit was

$47 billion higher than the year before — even though revenues came in

$8 billion higher. Turns out that, despite all the protests, the screaming, and

purple-hair-pulling and nose-ring-wiping about President Donald Trump's "devastating cuts,"

spending in July was $55.5 billion higher than it was a year ago. What's more,

there were jumps for outlays for agencies such as Veterans Affairs (up $3 billion

year-over-year), Medicaid (up $15 billion), the EPA (up $195 million), the National

Science Foundation (up $14 million) — all of which were supposedly being slashed

and burned. In fact, just five of the 15 Cabinet-level agencies spent less this July than

they did last year. As we've pointed out many, many times in this space, when it comes to

spending cuts, both sides exaggerate what's going on. Democrats do so because they want

never-ending spending increases, and Republicans do so because they want to look like fiscal hawks.

Democratic

Party tries to pin 'record high' 2025 grocery prices on Trump — but it completely

backfires. The Democratic National Committee (DNC) drew widespread mockery Thursday

over a since-deleted social media post that showed how the cost of groceries skyrocketed under

former President Joe Biden. The X post included a graph of soaring cheese, alcohol, dairy,

grocery, produce and meat prices dating back to October 2019, with the major inflection point

being near the start of the Biden administration in 2021. "Trump's America," read the tweet

shared by @TheDemocrats. "Prices are higher today than they were on July 2024 all in

major categories listed below," read the caption on the graphic, which did not note the source of

the data.

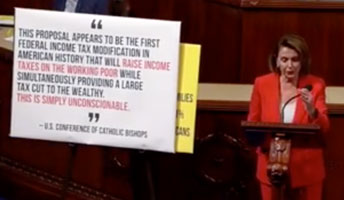

Time

to Say It Out Loud: The Trump Tax Cuts Worked. In politics, good news is rarely

treated as news at all. For the past seven years, the Trump tax cuts have been maligned,

distorted, and largely ignored, especially when the data didn't fit the preferred narrative. [...]

The Tax Cuts and Jobs Act (TCJA) of 2017 wasn't just a win for corporations and the wealthy; it was

a massive boost for working Americans, middle-class families, and small businesses. But you

wouldn't know that from reading most mainstream coverage. Instead, they parrot the same tired

talking points: "It ballooned the deficit," "It was a handout to billionaires," "It didn't

help regular people." The truth, as usual, is more complicated and far more favorable to the

American taxpayer than the critics care to admit. One of the most pervasive lies about the

TCJA is that it somehow hurt the middle class. In reality, it did the opposite.

According to data from the Congressional Budget Office and IRS filings from the years immediately

following its passage, middle-income earners saw their effective tax rates drop.

Let's

Be Honest, The 'One Big, Beautiful Bill' Doesn't Cut Spending At All. It is axiomatic

that both Republicans and Democrats will exaggerate the size of any spending cut proposal, for the

simple reason that it appeals to their partisan supporters. The "One Big, Beautiful Bill" is

no exception. The numbers tell the tale. There are no spending cuts, at least, not in

the way every household on a budget would count as a cut. That's not what the headlines

scream. Instead, it's all things such as this from the left:

• "Deepest Cut in History"

• "Would Take Food Assistance Away From Millions of Low-Income Families"

• "Devastating Our Healthcare System"

Meanwhile, the White House is telling us that "There's $1.6 trillion worth of savings in

this bill. That's the largest savings for any legislation that has ever passed Capitol Hill

in our nation's history." We're told that "deficit hawks in the Senate like Rand Paul and Ron

Johnson are drawing a red line — pushing for deeper cuts than those in the bill the House

sent to them." Which also implies that there are spending cuts. Not only does the One Big,

Beautiful Bill (OBBB) not cut spending, it barely makes a dent in projected increases in

federal spending.

Universal

Income? It's Already Here. Let's put aside Social Security and Medicare, which

are, for the moment, largely funded by payroll taxes. That leaves the programs financed by

the income tax. Medicaid, food stamps, federal housing subsidies and almost 100 other

means-tested programs added up to $1.6 trillion in 2023. That's twice as much as

defense. My inner accountant tells me that total social spending, funded by both income and

payroll taxes, is big, $3.95 trillion in 2023. If you exclude debt service on the grounds that

interest is met through additional borrowing, social spending is 74 percent of the total

budget. And then there are the taxes we don't have. Europe, Japan and China

impose a Value Added Tax on consumption. The VAT is similar to a sales tax in the U.S., but

the rates are much, much higher, often touching 25 percent. The VAT falls heavily on the

poor because the tax comprises a larger portion of their income. There is no VAT in the U.S.,

so Americans at the bottom never suffer this regressive tax burden.

Despite

What You've Heard, Trump's Budget Doesn't 'Slash' Spending — It Barely Trims

It. President Donald Trump did something extremely rare in Washington on

Friday. He offered a budget plan that proposes actual, honest-to-goodness cuts in spending

next year. Which helps explain the hysterical reaction from the usual suspects.

Normally, White House budget proposals claim to be cutting spending when all they are doing is

slowing the growth in spending. Or they promise spending cuts far down the road while

boosting outlays in the short term. But the budget outline Trump released Friday does none of

that. In sticking with Trump's "revolution of common sense," when it says it cuts spending,

it cuts spending — meaning spending less next year than this year. Trump wants to

reduce spending on domestic programs by $163 billion next year — which would be

almost 23% less than the federal government will spend this year on things such as education, the

environment, energy, transportation, foreign aid.

Democrats

Sound an Urgent Warning: Trump Is Behaving Responsibly. This is what the

national debt clock said at 10:30 this morning: [Screenshot] Facing that sea of red ink,

Democrats have just released a detailed tracker that shows how much money the Trump administration

has refused to spend, leaving it in the Treasury. Literally, HUGE WARNING: DONALD TRUMP ISN'T

GIVING AWAY HUNDREDS OF BILLIONS OF DOLLARS, THIS IS A CRISIS. I can't imagine how we ended up

with $37 trillion in federal debt. The Trump tracker project is built on an absolutely

extraordinary foundational presumption, which you can spot in their title alone:

["]100 Days In, Trump Blocks At Least $430 Billion Dollars in Funding Owed to

American People["] The money is owed to the American people. Who owes it to

them? What's the source of the money? The American people are owed money by the

American people. We aren't giving our money to ourselves. Batman villain Rosa DeLauro,

the Connecticut congressional barnacle that attached itself to our faces 34 years ago and

apparently can't be pried loose, says in a statement that Trump is "insisting our country cannot

afford to help families make ends meet." So the government takes money from American

families, then gives the money to... American families. And that helps them to make ends

meet, see. Reducing your taxes and your share of government debt costs because government

spends less wouldn't help you make ends meet, because that's only your own money. It doesn't

start to help until the government takes it from you so the government can give it to you.

Inflation

Cools Off: Media Hardest Hit. The general consensus among informed political

analysts is that the Republicans emerged from last November's election in control of the White

House and Congress due to the border crisis and persistent inflation. The Trump

administration curtailed the influx of illegal immigrants with remarkable speed and the Consumer

Price Index (CPI) for March suggests that inflation is also returning to the modest levels that

prevailed throughout President Trump's first term. The CPI declined by .01 percent last

month, a year-over-year rate of 2.4 percent, while core inflation sank to a four-year

low. Moreover, wholesale prices also decreased in March. According to the Producer

Price Index (PPI) report, an important indicator of future inflation pressure, "Prices for final

demand goods moved down 0.9 percent in March, the largest decrease since falling

1.4 percent in October 2023." These PPI statistics, combined with the CPI numbers,

clearly portend a brighter future for long suffering consumers and the nation's economy in

general. But the legacy media are loathe to report good news if it reflects well on the new

Trump administration.

No,

a 50-percent tariff doesn't mean a 50-percent price hike. The tariff doomsday machine

is roaring again. This time, it's over talk of a 50% tariff on certain imports.

Predictably, the panic-peddlers are out in force, warning that such a tariff means retail prices

will skyrocket 50%. It's an easy line to chant, but it's wrong — flat

wrong — and anyone with a basic grasp of economics should know better. Let's make

one thing clear: a tariff applies to the transaction value, not the final retail

price. The transaction value is what the importer pays the exporter, plus freight and

insurance. That cost is just the first step in a long supply chain. By the time a

product reaches the consumer, it's been marked up to cover domestic shipping, warehousing, employee

wages, utilities, sales tax, and profit margins for every hand it passes through. The tariff

is just one input among many.

Whoopi

Goldberg Falsely Claims Egg Prices Have Not Come Down Since Trump Took Office. Egg

prices have not fallen by "one cent" since President Donald Trump took office, "The View" co-host

Whoopi Goldberg gushed Wednesday. She's wrong. Egg prices have fallen 44 percent

since the start of 2025 after prices had soared to record levels under former President Joe Biden's

administration, according to Trade Economics. Despite the significant fall in egg prices,

Goldberg claimed she has not seen these prices fall in any way, shape or form. [Tweet]

Redefining

Prosperity: Lutnick, GDP, and the Myth of Government-Driven Growth. Consider

this: If a family cuts its cable subscription, has it grown poorer? On the contrary, it

may be optimizing. Similarly, when a government trims wasteful programs, the economy does not

necessarily shrink — except under the old GDP model, which treats every dollar spent as

sacrosanct. [Secretary of Commerce Howard] Lutnick's reform corrects this distortion. It

decouples the illusion of growth from the mere act of spending, allowing policymakers to make cuts

without conjuring recessionary shadows. The practical implications are profound.

Imagine a GDP that distinguishes between the construction of a bridge and the convening of yet

another DEI symposium. Under Lutnick's plan, only the former would be counted. This not

only clarifies what constitutes real economic value but also emboldens policymakers to pursue

fiscal discipline without fear of being labeled as anti-growth. The reform is as much about

public psychology as it is about statistics.

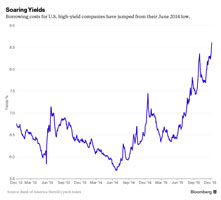

The

Economic Data Is Wrong And The Fed Should Have Cut Rates. The Federal Reserve decided

not to cut interest rates yesterday [3/19/2025]. I believe this is a mistake on their part and

is another data point proving the Fed is continuously behind the curve when it comes to monetary

policy in the modern age. If you remember, the central bank didn't raise interest rates until

inflation was already out of control during the pandemic. We eventually saw inflation

officially hit 9% according to the government data. Inflation was not transitory as they

predicted and the American consumer suffered dearly. A big reason for the Fed's persistent

lag is they have a data problem. Not only is the data backwards looking and lacks real-time

accuracy, but the economic data is no longer trustworthy. The Bureau of Labor Statistics was

forced earlier this year to revise down the number of jobs created in the last year by nearly

600,000 jobs. It is insane how inaccurate the jobs number has become. But that is not

the only issue with economic data. I have been convinced that you can not trust most of the

reported data. Do you believe the official inflation metrics? I don't. A good

question to ask yourself is whether you think more than 50% of the data is accurate or

inaccurate? I am in the camp of majority of the data being inaccurate when it is reported.

Inflation

cools in first full month of Trump term but egg prices soar. Consumer prices rose

2.8% in February compared to a year ago, easing slightly over the first full month under President

Donald Trump and offering welcome news for markets roiled by a global trade war. Inflation

cooled more than economists expected. The S&P 500 and tech-heavy Nasdaq closed

higher on Wednesday, preserving early gains in the immediate aftermath of the release of the

inflation report. [...] Price increases slowed from a 3% inflation rate recorded in January, though

inflation remain nearly a percentage point higher than the Federal Reserve's target of 2%.

The Editor says...

[#1] ABC News seems more alarmed by Trump's 3 percent inflation than they were by Biden's

9 percent rate. [#2] Inflation is not the problem with egg prices. The problem with

eggs is that Joe Biden had millions of chickens destroyed in an over-reaction to "bird flu," which,

if it exists at all, was never a problem in the 20th century. Maybe it's not a good idea,

after all, to have two or three companies raising all the chickens in Astrodome-sized barns,

instead of getting eggs from family-owned farms. (See

also, Scorched-Earth

Disease Control.

Whoopi

Goldberg Claims Trump Ruined Biden's Wonderful Economy Without Once Mentioning High Prices.

"The View" co-host Whoopi Goldberg claimed Tuesday that President Donald Trump ruined former

President Joe Biden's economy without once mentioning high prices or the record high deficit.

Goldberg argued that Trump inherited a "very robust" economy, crediting the Biden administration

for adding nearly 16 million jobs to the U.S. economy, though she failed to mention this was

largely a result of the U.S. recovering from the COVID-19 pandemic. The co-host also did not

mention that inflation rose to a peak of 9% during the Biden administration and that the deficit

reached record-breaking levels largely due to the previous White House's high spending.

No,

Sen. Slotkin — Elon Musk Is NOT 'Going After Your Social Security and Medicare'.

Since the beginning of my interest in national politics (more than a few years ago), the favorite

tactic (baldfaced lie) of the Democrat Party has been scaring America's seniors into believing that

the evil Republican Party is going to "take away" (or "cut") their Social Security benefits.

As the Baby Boomer generation began to age, the Democrats tacked on Medicare to their fearmongering

scam, fully aware that other than outliving their income, seniors most fear the ever-rising cost of

medical care. So why do the Democrats continue to parrot something so deceptive, if not

downright evil? Because, just as we're now seeing, the Democrat Party is a deceptive hollow

vessel that offers zero solutions — particularly when President Donald Trump and the

Republican Party continue to offer plenty — and so, just as they have done for decades,

Democrats continue to delusionally believe that attacking Trump, and conservatism in general, is

their only way to win. Should we tell them, or should we welcome their lies and expose them

at every opportunity? (Pick "b.")

Biden-Backed

Green Group Wired $651M in Taxpayer Money to Credit Union Accounts. The EPA Says It Now Has

No Oversight of the Funds. The Environmental Protection Agency has no ability to

track or conduct oversight of more than $650 million in taxpayer funds that a Biden-backed

green group wired to dozens of credit union accounts last month, the agency told the Washington

Free Beacon. In mid-February, the New York-based eco group Inclusiv — which

received $1.9 billion last year as part of the EPA's $27 billion Greenhouse Gas Reduction

Fund program — transferred $651 million to 108 credit unions across 27 states

and Puerto Rico. The group said the credit unions would use the funding to offer financing

for green energy projects such as solar installations and electric vehicle chargers within their

jurisdictions. Inclusiv initiated the transfer on the same day that EPA administrator Lee

Zeldin discovered that the Biden administration had parked $20 billion in Greenhouse Gas

Reduction Fund funding in accounts at an outside financial institution, limiting federal control

and oversight of the money. In collaboration with the Department of Justice, Zeldin

ultimately froze the accounts, but not before Inclusiv completed its transaction.

Left-Leaning

Economist: Bidenomics Was an Expensive Failure. Jason Furman is a left-leaning

economist who currently works at Harvard but who previously served as chair of the Council of

Economic Advisers under President Obama. So his recent takedown of Bidenomics is coming from

an ally of the party not an outsider. Furman's analysis starts with the fact that

voters rejected Biden and Harris because in their view Bidenomics was not a rousing success.

If you had to point to a single cause for widespread dissatisfaction with Biden's tenure, it would

probably be inflation. [...] The core problem was inflation, and on this point Furman goes into detail

to argue Biden entered office with a plan to spend far more money than was needed at the time.

The

Corporate Media Rediscovers Inflation. White House press briefings are often tedious

affairs, but sometimes a reporter will ask a question so inane that it provides comic relief.

On Jan. 29, for example, the Washington Examiner's Christian Datoc put this howler to

Press Secretary Karoline Leavitt: "Egg prices have skyrocketed since President Trump took

office. So, what specifically is he doing to lower those costs for Americans?" The average

price of a dozen eggs escalated from $1.47 to $4.95 during former President Biden's term, yet this

crack reporter was laser focused on how "egg prices have skyrocketed" during the first nine days of

the second Trump administration. [...] But this preoccupation with egg prices is not limited to

Datoc. As Paul Kengor, our Executive Editor here at the American Spectator, noted

last week, alleged "news" outlets like CNN are using egg prices as an analog for inflation in

general and demanding to know why Trump hasn't yet fixed it.

Mythologies

About Musk. [#1] "Musk has no right to cut USAID." Elon Musk and his team are

not cutting any federal programs. They are auditors. They were given legal authority

under a presidential executive order creating the Department of Government Efficiency (DOGE).

Its mandate is to identify waste, abuse, fraud, and irrelevance in the federal budget at a time

when the U.S. is $37 trillion in debt. The agency will expire on July 4, 2026.

Ultimately, Musk can propose program cuts, but Trump holds the authority to approve or reject

them. He may or may not act on all, some, or none of the DOGE recommendations.

[#2] "No one elected Musk." Like hundreds of government officials, Musk was appointed

by an elected president to run an agency that does not require Senate confirmation. Musk is as

legally legitimate as the national security advisor and his National Security Council, none of whom

require Senate confirmation. Does the left believe former national security advisor Jake Sullivan,

who made decisions far more pivotal than Musk, had no authority to do so because he too was neither

elected nor confirmed by the Senate?

Is

The National Debt Growing Faster Than We Thought? The widely quoted annual deficit

number is $2 trillion. In layman terms, the United States spends $2 trillion more

than we pull in as revenue. That is obviously not good. But we got even worse news

recently. The US government is not running a $2 trillion deficit. They are

actually running a ~ $2.5 trillion deficit based on the annual run rate from the first four

months of the 2025 fiscal year. Geiger Capital points out "the first four months of FY 2025

produced a deficit of $838 Billion. That's $306 Billion more than the deficit recorded

in the same period last fiscal year. We're running a $2.5 TRILLION annual deficit."

DOGE

Is Deadly To The Swamp And A Ray Of Light For The American Taxpayer. Badly defeated

and desperately trying to crawl out of the political wilderness, Democrats are choosing to die on

the government-waste-is-good political hill after holding a four-year orgy of waste. They are

great at projection. You've got to give them that. "What we are witnessing here is the

biggest heist in American history," deranged Sen. Chris Van Hollen said at a protest Wednesday

near the U.S. Capitol. The Maryland Democrat made the rounds this week at a series of D.C.

protests and press conferences in support of the United States Agency for International

Development, or USAID, the poster-child for galling waste, fraud, and abuse in government.

Van Hollen and posse got together for Wednesday's made-for-corporate media political temper

tantrum, decrying Trump's move to dismantle the corrupt foreign aid dispenser, one of the swampiest

agencies in the fetid swamp. He described Elon Musk leading the Department of Government

Efficiency as "the most corrupt bargain we've ever seen in American history." Apparently, the

senator is unfamiliar with the Biden family's body of work.

Sen

Dem: If USAID Doesn't Keep Sending Money to Terrorists, Americans Will Be 'Unsafe'.

The reconstruction of USAID from an independent terrorist and international leftist funding entity

to a subsidiary of the State Department has Democrats involved in the foreign policy apparatus

freaking out and desperately trying to get Americans to care. [...] The reality is USAID had us

sending $600 million to Pakistan, $3.7B to Afghanistan after the Taliban takeover,

$2 billion to the PLO and Hamas after Oct 7, and $3.4B to Yemen whose Houthi regime we're

currently at war with. How does funding Islamic terrorists combat extremism and protect our

homeland? "Our foreign assistance and engagement wins us friends around the world,

establishes our leadership and, more important, neutralizes distant threats to the United States

well before they put our country at risk," [Senator Chris] Coons claims.

With

Trump imposing tariffs, suddenly the media is concerned about inflation. President

Trump is imposing tariffs on Canada, Mexico, and China to force them to help the U.S on illegal

immigration and drug trafficking. The media and other Democrats are complaining that it will

cost Americans more than $800 even though Trump's tariffs in his first term caused little if any

inflation — tariffs don't cause inflation, government money-printing does. During

the election they predicted the cost would be $4,000. Historical results mean little to

Democrats. Somehow the media campaigned to reelect Democrats even though their monetary

policies, printing cash like there was no tomorrow, caused more than 20% inflation in four

years. That means a family spending $70,000 in 2020 would have had to spend $14,000 more per

year just to keep up but somehow they are now worried about $800 more?

Senator

Claims $50M in Condoms Needed to "Keep Malnourished Babies Alive in Gaza".

Sen. Chris Murphy (D-Tehran) doesn't seem to have gotten the memo that the famine hoax has

fallen apart and Hamas tossed it aside after the Biden-Witkoff deal allows it to claim

victory. But after the Trump administration froze the gravy train of aid, including

$50 million in condoms for Gaza, Sen. Murphy tweeted that "It's a lie. Made

up. There was no U.S. funding for condoms in Gaza. What he stopped is programs to keep

malnourished babies alive in Gaza. Aid groups say infants will start to die next week."

Everyone knows the perpetually malnourished infants in Gaza can't live without condoms. That

then get turned into bombs.

Democrats

Lose Their Minds Over Trump's Funding Freeze, Then Flat-Out Lie About Its Impact.

Despite Press Secretary Karoline Leavitt's more than precise outlining of what was and was not

affected by President Donald Trump's executive order freezing funding for federal grants, loans,

and other financial programs pending agency review, along with a memorandum from the Office of

Budget and Management (OMB) outlining the same, Democrats took this opportunity to rail against

dictator Trump, fearmonger, and have an absolute meltdown. [Advertisement] [Tweet with

video clip] The detailed memorandum was even distributed to the White House press corps.

Biden's

Crowning Legacy: 20% Bidenflation And The Economic Carnage Left Behind. Which is the

bigger cover-up — Biden's frailties or Bidenflation? The so-called experts, Nobel

laureates, and leftist media elites have the chutzpah to hoodwink Americans into believing

inflation is 'under control' just because CPI dropped from its 9.1% peak under Biden. But ask

any hardworking family, and they'll tell you the truth — prices didn't go back down;

they just stopped rising as fast. [...] When Biden took office, inflation was at just 1.4%. Since

March 2021, inflation has consistently remained above the Federal Reserve's 2% target (46

consecutive months). Under Biden, the federal debt has increased by $8.4 trillion. To

finance the President's spending spree, the Federal Reserve printed money from nothing. The

increased money supply, without a corresponding increase in goods and services, reduced the value

of each dollar, causing prices to rise quickly and leading to high inflation, effectively acting as

a hidden tax on everyone. Prices have increased by 20%, while real wages have declined by 3.2%.

Bidenflation

Is Still Exploding Food Prices. We've been told for four years that inflation will

soon stabilize and disappear thanks to Joe Biden's awesome stewardship of the economy, and yet...

"Wholesale prices for chicken eggs soared by nearly 55% last month, and wholesale food prices rose by

3.1% (their highest monthly increase in two years)," reports far-left CNN. [Advertisement]

Ahh, and because a Democrat is in office, we are then immediately told... [Advertisement]

["]Economists say not to panic. The "egg-flation" and sudden price hikes in some major

food categories are reflections of isolated incidents rather than something systemic and indicative

of a reacceleration of inflation.["] Economists always tell us not to worry when a

Democrat is president.

In

"Last Hurrah", Credit Card Debt Explodes Higher Despite Record High APRs As Savings Rate

Craters. One month ago, when multiple discount retailers were lamenting the sudden

collapse in US consumer purchasing power, we highlighted the reason this unexpected hit to US

consumption: as the US personal savings rate had collapsed, the growth in consumer credit was

slowing, and in last month, the Fed reported that credit card debt growth posted its first decline

since the covid crash. But fast forwarding just one month later, when in a striking reversal,

October consumer credit growth unexpectedly reversed the dramatic September slowdown, and soared

more than $19 billion, to a new record high of $5.084 trillion.

We

Have Been to the Grocery Store. The Democrats began their term with a trillion dollar

+ spending bill. That spending caused inflation by sending too many dollars after the same

goods and services in the U.S. economy. Prices of all consumer goods exploded to previously

unknown heights. While the rate of inflation cooled as interest rates rose, prices remain

high and consumer spending power was crippled. All this misery remains well known even though

the MSM tries to distract us with other issues. It remains well known because it is real in

the experience of the average person. We are reminded of inflation every time we visit a

grocery store or a gas station. Our experience became more memorable when pranksters —

with justification — would place stickers depicting Joe Biden saying "I did that!" next to

the prices on gas pumps. The shocking memory of gasoline reaching three, four and then five

dollars a gallon did not go away even when prices peaked and retreated somewhat. [...] With the help

of a compliant media, the Democrats have managed to blame inflation on Putin, Covid, "climate change"

and a host of other irrelevant factors. With their base distracted by these diversions, the

Democrats can continue to buy votes with government programs.

KJP

gets wrecked after boasting how much cheaper Thanksgiving meals are. Sounding like a

broken record, White House Press Secretary Karine Jean-Pierre was once again boasting about how

much cheaper Thanksgiving meals will be this year under the Biden-Harris administration. In

addition to noting that the average price of a Thanksgiving Day meal fell 5 percent, KJP

boasted about gas prices being down .25 cents [sic] per gallon. However, the administration

still does not seem to grasp that any focus on pricing invites a larger analysis that doesn't work

out in its favor. When looking at price fluctuations compared to the previous administration,

consumer costs are still up significantly. On that note, voters let their sentiments be known

on Election Day, not that the Republican Party is shy about reminding folks just how much more they

are paying now. [Tweet]

No

one should believe economists — they are apologists for bad policies. Here

are some of the actual Biden, Harris policies that led to high inflation: Doling out massive

amounts of taxpayer money to buy votes when the economy was already rapidly growing. There is

no excuse for running a $2 trillion deficit this year, in a supposedly growing economy.

They're just masking the problems. Flooding the United States with millions of illegals

because Biden and Harris reversed Trump's policies and ignored the law. Issuing massive

amounts of new regulations is clearly inflationary. Blocking pipelines and drilling on

federal lands while publicly seeking to destroy companies that use natural resources to produce

reasonably priced energy causes inflation in the U.S. and throughout the world. Forcing

people and businesses to buy expensive health insurance policies instead of fostering freedom of

choice. The media and other Democrats intentionally lie and claim that Obamacare has made

health insurance more affordable; the truth is that prices have skyrocketed for 14 years

because of the Affordable Care Act. Throwing money at colleges for 60 years has

certainly added to inflation. Then, we had a president who dictatorially paid off the loans

using other people's money and debt, which is also inflationary. Forcing car companies to

make expensive electric cars and trucks that people don't want is obviously inflationary. It

raises the prices of gas-powered cars, which covers the losses and all the capital investments.

Today's

real inflation rate is closing in at 40%. Updated, accurate reports have just been

released by distinguished economists, federal watchdogs and reputable fact checkers on the actual

economic situation — according to these, the U.S. has been in a recession since 2022,

and the real inflation rate is now hovering close to 40%. Most recently, the Brownstone

Institute indicated the actual inflation rate as close to double the "informed" rate from media and

government sources: [...] So, here's where we really find ourselves: Trapped by an on-going

recession and inflation off-the-charts, and coming for us still in 2025, without a change in

presidential leadership. Don't tell Biden and Kamala — apparently, they don't want

to know about any of this.

US

Economic Income and Output Have Fallen Overall for Four Years. Many have questioned

the accuracy of official inflation statistics, with dozens of academic papers written on the topic

and doubts voiced by sources ranging from the New York Times to former President Donald

Trump. This matters not only because of the political salience of rising prices, but also

because official inflation numbers are used to calculate real economic growth by adjusting nominal

dollars to inflation-adjusted dollars. [...] According to our adjustments, cumulative inflation

since 2019 has been understated by nearly half. This has resulted in cumulative growth being

overstated by roughly 15%. This is a large amount for just 5 years — for

perspective, peak-to-trough drop in real GDP during the 2008 crisis was 4%. Moreover, these

adjustments indicate that the American economy has actually been in recession since 2022.

These conclusions are in stark contrast to the establishment narrative that the US economy is

enjoying robust growth that for some reason the public is incapable of perceiving.

2024:

Voting by Facts, Not Feelings. When Harris and Biden stepped into office in 2021,

they inherited Trump's 1.4% inflation rate. They quickly exploded the overall inflation rate

to 19.75 by passing the American Rescue Plan Act. Then, in August 2022, the Senate

passed the Inflation Reduction Act because of Kamala's tie-breaking vote. That act authorized

$891 billion in additional spending, massively increasing inflation. Harris's philosophy

of restricting gas and oil production had a substantial detrimental effect on American

consumers. The national average cost of gasoline under Kamala rose 47%. Americans paid $2.28

per gallon under Trump, but that same gallon would cost $3.35 today. Under Kamala, filling up

a 20-gallon gas tank would cost Americans $67; under Trump, it would cost only $45.60, or $21.40

less. The increase in fuel costs put incredible hardships on truckers who ship various goods

across the country. The unnecessary increase had a catastrophic domino effect.

Groceries became more expensive by 20%, electricity went up 28%, and rent went up 21%.

Nearly everything Americans purchased became far more costly.

Many

Little Lies. The Democrats' campaign against Donald Trump has been characterized by

so many lies that it is impossible to respond to all of them. The sheer volume of lies

prevents observers from learning the truth about any of them. A large number of lies makes

any particular lie more credible. But we must do our part to document the truth —

if for no other reason than that it is the truth. Democrat ads claim that Trump has proposed

a "national sales tax" of $4,000 per household. Trump has proposed no such thing. When

called on it, Democrats point to left-wing think-tanks that claim that prices will rise by $3,900

as a result of Trump's proposed tariffs. (That number is disputed among experts.) A

"national sales tax" is very different from the consequences of tariffs. Tariffs exist

now — even under the Biden administration. Foreign countries impose crippling

tariffs upon American products while subsidizing the products they send here.

A

fraudulent Federal Reserve. When Joe Biden took office, inflation took off because

of his policies, yet the Federal Reserve pretended that inflation was transitory for a while.

It didn't admit that open borders, increasing regulations, out-of-control spending, and

destructive, radical energy policies were causing inflation. Jerome Powell, head of the

Federal Reserve, somehow doesn't understand that flooding America with illegal immigrants puts

massive pressure on prices. Any person with common sense knows if more people demand housing,

medical care, education, and everything else, then that additional demand puts great pressure on

prices — but Powell said it is neutral. Why does anyone trust him?

Kamala

Harris and the 'Fair Share'. A PAC supporting Kamala Harris runs an ad that features

Harris making the following impassioned statement, "We are helping dig families out of debt by

telling billionaires to pay their fair share!" The commercial presents this exclamation as Harris'

"reason for running" for office, but does not explain what it means. Some of the audience

tries to guess what this statement means while Harris' supporters do not care and will vote for her

regardless of what she says. Those who care to understand must speculate for an

explanation. To whom will "billionaires" pay this undefined "fair share?" We can guess that

she is talking about paying taxes. She does not explain how billionaires paying more taxes

will help dig families out of debt.

The Editor says...

"Dig[ging] families out of debt" is not the proper role of government, and was never seen as such

until very recently — and even then, only by politicians.

Realities

cannot be denied. Are Americans better off now than four years ago? The

reality: A trip to the grocery store tells us that food prices are substantially higher now

than they were when President Trump was in the White House. We are paying more at the gas

pump and this administration has practically drained our oil reserves; leaving our National

Security at great risk, we are not ready for an attack or any other emergency that might

arise. Because Secretary Petey Buttigieg does little to nothing, our infrastructure is

crumbling, and the supply chain is struggling. We have not recovered since COVID and there

are still empty shelves in the grocery stores.

Why

the Biden-Harris "Strong" Economy Claim Is a Big Lie. There is only one way to rescue

America's faltering economy and that's the wholesale abandonment of Washington's reckless spending,

borrowing and printing policies of the last quarter century. These policies did not remotely

attain their ostensible goals of more growth, more jobs and more purchasing power in worker pay

envelopes. What they did do, of course, was to freight down the main street economy with

crushing debts, dangerous financial bubbles, chronic inflation and stagnating living

standards. For want of doubt, go straight to the most basic economic metric we

have — real compensation per labor hour. The latter metric not only deletes the

inflation from the pay figures, but also measures the totality of worker compensation, including

benefits for health care, retirement, vacation, disability, sick leave and other fringes.

An obvious lie:

Doug

Emhoff: Not Fair To Criticize Kamala Harris For The Admin's Failures. Vice

President Kamala Harris' husband, Doug Emhoff, claimed during an interview this week that it was

unfair for people to criticize his wife's performance over the last three and a half years because

she was not the president. Emhoff made the remarks during a softball ABC News interview

Friday morning on "Good Morning America," which came just days after the network's debate between

Harris and former President Donald Trump that was extremely biased against the Republican

nominee. Co-anchor Michael Strahan asked Emhoff if he thought it was fair that his wife was

being criticized for the numerous failings of the administration, even though she was named the

border czar, bragged about being the last person in the room on Afghanistan, and was the

tie-breaking vote on passing the American Rescue Plan — the legislation that triggered

the inflation crisis.

The

most important aspect of the Haitian scandal. [Thread reader] ... is how it

reveals the whole "they work/help the economy" stuff to be an absurd farce and a lie. The

reason Haitians "work" is because they get mountains of free stuff paid for by the taxpayers in

exchange. A company can employ Haitians at the absolute minimum wage because the Haitians get

free healthcare, free food, free housing, and even cash stipends which they refer to as "magic

money cards": because the cash never runs dry. This is all subsidized by taxpayers.

So most companies, "small" and "local" businesses included, would rather pay slave wages to

foreigners who are more than happy to show up to work because they know in exchange for doing so

they will receive mountains of rewards from NGOs, charities, and the government. Meanwhile

the American citizens are turned into wealth extraction machines. They pay all the taxes,

don't get these same benefits, and are still forced to work for cheap wages. They can barely

make ends meet. Inflation is killing them at the pump, at the grocery store and everywhere

else in their lives because they have no reprieve from its effects and no political recourse to

stop it. But the foreigner gets shielded from this. They don't care about their wage or

the cost of food, or rent prices, because it is all paid for by other people.

Kamala

Harris, Inflation, and Rip-Offs. That a political party would intentionally mislead

its voters as to the cause of inflation should be a major scandal. While we tend to excuse

such actions as mere election-year politics, these ads and the strategy behind them transcend any

one election. Inflation has raged in alternating cycles of boom and bust since before the

Great Depression. It robs us of our savings and transfers wealth without the victims'

understanding or even knowledge. This travesty can happen only because the truth about

inflation is drowned in the steady drip of misleading ads and political statements. Contrary

to the claims of politicians, inflation is not something that the government must "fight."

The government does not "bring down costs." The government need only stop inflating. There is

nothing to fight except the government's own printing press. There is no need for legislation —

especially an Inflation Reduction Act. The government need only stop creating new dollars.

Bidenflation

Still Hammering the Working Class — Minorities Hardest Hit: WaPo.

Has inflation begun to ease back to normal? The Biden-Harris administration wants voters to

believe it, arguing that consumer-goods prices appear to have stabilized. Have they?

Today's Producer Price Index shows annualized unadjusted wholesale inflation dipping down to 1.7%

in August. That would be welcome news for consumers, but inflation for wholesale consumer

foods hit 4.2%. Most of the overall decline came in wholesale energy prices (-8.4%), which

consumers will also welcome but may not be all that good of a trade-off from their weekly visit to

grocery stores. Yesterday's Consumer Price Index offered a mixed bag, too, but not for the

middle and working classes. The overall annualized rate dropped from July's 2.9% to 2.5% in

August, again mainly because of a dramatic fall in energy prices (-4.0%). The upward spike

continued in shelter costs, shooting up 5.2% in August, and included both rentals (5.2%) and owner

costs (5.4%). Insurance spiked 3.6%, and municipal utilities went up 4.2%.

It's

Not the Fed That's Causing Inflation. In their first week in January 2021, Joe

and Kamala cut off every source of oil within their jurisdiction. In the very next month,

three things happened: our domestic production of oil plunged from 13.1 million barrels per

day to 9.7, oil prices doubled from $55 to $110 per barrel, and the monthly inflation rate leaped

from 1.4 percent to 9.6 percent. The red-herring inflation chart they offer shows

inflation peaking six months later, which distracts from the fact that their action was the sole

cause of inflation. It is a "trailing average" chart. It takes the 9.6-percent monthly

rate and averages it with the previous 11 months, which averaged 1.8 percent, and so on.

Thus, the peak of inflation appears to happen six months after it actually peaked. A monthly

chart would show the truth: that the reduction of oil supply was the direct cause of inflation.

Gas

Prices Have Increased 50% Since Kamala Has Been In The White House. Americans are

largely unable to find the "joy" Democrats have touted, especially when they hit the gas pumps, as

prices have risen 50 percent since Vice President Kamala Harris has been in the White

House. According to data from the U.S. Bureau of Labor Statistics, not seasonally adjusted,

the cost of gasoline has risen 50 percent since January 2021. This is a stark reality

Americans are all too familiar with. During the second year of the Biden-Harris

administration, gas prices actually broke record highs several times.

Economic

Lies and Presidential Politics. Inflation, as the name implies, is an increase in the

money supply. That's it, nothing more. There is only one entity that can increase the

supply of money: the federal government. States can't do it, cities can't do it, Warren

Buffett can't do it, Kim Kardashian can't do it. Only the federal government can inject that

money into the economy, either from taxation/fee receipts or from borrowing (that is, the issuance

of government bonds). When the money injection results from borrowing, we call it printing

money, and when done to pay off deficit or debt, it is called monetizing that debt. Adam

Smith called this a "pretend payment" way back in 1776!

14

Lies Kamala Harris Told During Her DNC Speech. [#6] Kamala Harris falsely insinuated

that the 2017 tax cuts approved by the Trump administration disproportionately benefited America's

wealthiest citizens. "[Trump] fights for himself and his billionaire friends," Harris claimed.

"And he will give them another round of tax breaks that will add up to $5 trillion to the

national debt." That is not true. Data produced by the IRS has shown that "on average all

income brackets benefited substantially from the Republicans' tax reform law, with the biggest beneficiaries

being working and middle-income filers, not the top 1 percent," according to The Hill.

10

Lies Leftists Tell You. Lie #10: The U.S. economy's great; you just don't know

it. Perhaps this seems true to all the millionaire actors, athletes, newscasters,

entertainers, and academics so fond of smooching Democrat derrières. But for those of

you like me, who have to pay bills and balance checkbooks, this is not the best of times, but the

worst. I mean, Burger Kings are going out of business. Dollar Stores have had to come

up with a new name since almost everything costs more than a dollar these days. Personal

credit debt is at a record high, not to mention our astronomic national debt. How can anyone

tell this particular lie without covering the smirk on his face?

Who

is Gaslighting Whom? When a politician tells you they can ban grocery store price

gouging, isn't that gaslighting, straight up? Because, as far-Right misinformation terrorists

have reminded us, politicians have been promising to freeze prices for 2,000 years, and it

never worked. [...] So when Kamunist Harris mournfully regrets that "A loaf of bread costs 50% more

today than it did before the pandemic. Ground beef is up almost 50%" is that gaslighting or

what? Those price rises happened on her watch. But does she apologize for the failed

policy of the Biden-Harris administration? Hey no. It's all the fault of "price

gouging" corporations. I remember the heroic efforts of the price-gouging grocery chains to

keep food on the shelves during COVID.

The

Remarkable Transformation of Kamala Harris. Inflation is eating away at the

purchasing power of Americans' take-home pay, with prices of everyday goods up nearly

20 percent since Biden took office. The major contributor to inflation is federal

deficit spending. Harris's record in the Senate is unimpressive except when it comes to

spending money we don't have. By casting her tie-breaking Senate vote, Harris approved the

passage of Biden's American Rescue Plan of 2021 and the falsely titled Inflation Reduction Act of

2022. With these two bills, Harris added $1.9 trillion and $1.2 trillion (respectively)

to the national debt, exacerbating Americans' pain at the grocery store or gas pump.

U.S.

Families Spend $11.4K More Yearly Under Biden. Thank to Joe Biden-flation and his

catastrophic economic policies, American families are spending over $11,000 more annually just for

necessities. The obscene cost of inflation is hitting hardworking Americans, as overall

prices have gone up almost 20% since the Meanderer-in-Chief came into office in 2021. Americans can

thank the Biden administration for that $11,400 extra for necessities, about 20% of the average

U.S. annual salary. And if you hear the lie that inflation is down, don't believe it.

All that means is that the inflation rate is allegedly slowing, and the Biden administration loves

to engage in monkey business to manipulate such statistics.

Americans

Feel The Heat As Bidenflation Climbs Toward 20%. The dark reality of Bidenomics is

the alarming 19.5% inflation under the President's watch, which is 5.7% annually. When he

took office, inflation was at just 1.4%. Since March 2021, inflation has consistently remained

above the Federal Reserve's 2% target for 40 consecutive months. Under Biden, the federal

debt has increased by $6.9 trillion. To finance his spending spree, the Federal Reserve

printed money from nothing. The increased money supply, without a corresponding increase in

goods and services, reduced the value of each dollar, causing prices to rise quickly and leading to

high inflation, effectively acting as a hidden tax on everyone.

Contrary

To Media Claims, Inflation Index Shows Americans Still Face Sky-High Prices. Contrary

to the corporate media cabal's desperate attempt to paint the Consumer Price Index report for

June 2024 as a sign that inflation "cooled" and will continue "cooling" and "slowing" the

closer the nation gets to November's presidential election, Americans are still paying higher

prices on basic day-to-day goods and services than they did in the last four years. When the

U.S. Bureau of Labor Statistics released its latest inflation index showing a 0.1 percent

decrease in prices from May 2024 to June 2024, press outlets and the Democrat regime

rushed to bill the data as a sign that inflation is "at its lowest level in more than three years."

The New York Times' Paul Krugman, whose partisan commentary on American families' financial straits is

notoriously out of touch, claimed the CPI's report means the record high prices that have plagued the

nation are "plummeting." CNN also framed the latest month-over-month data as "Good news for US

consumers" because it indicated inflation "fell for the first time since the early part of the pandemic."

The Editor says...

Even if inflation goes to zero and stays there, the dollar has still lost a great deal of value in the last

three years. Zero inflation this month does not fix what happened to the dollar last year.

The

left's $7 trillion lie: Biden far outpaces Trump in racking up the national

debt. Projection is blaming someone else for your own bad behavior. We saw a

classic case of projection in Thursday's presidential debate, when President Biden — who

is overseeing annual budget deficits of $2 trillion — asserted that his

predecessor, Donald Trump, added more to the federal debt than anyone else. It's part of the

latest leftist argument: that if Trump wins the election, he will run deficits twice as large as

Biden would. Debate moderator Jake Tapper joined the chorus of federal finance falsehoods

when he claimed Trump had "approved $8.4 trillion in new debt," while Biden's actions will

increase the debt by (merely) $4.3 trillion over a decade. Tapper was referencing a

recent report by the left-leaning Committee for a Responsible Federal Budget, which twisted and

turned the debt statistics in every contortionary way it could to reach its incredible

conclusion. CRFB, by the way, is a group that opposed the successful Trump tax reform in

2017 — yet supported several of Biden's multitrillion-dollar spending bills.

Gullibility

101. The loony leftist assumes that the poor are poor because of the rich. The

wealthy have more than their fair share (as if wealth is limited — it isn't: it's

produced, but that's another discussion). So — if we raise taxes on the rich, we'll

have enough money to give a lot to the poor and we'll all be equal. Right? That just

beats all. How do they think the rich got that way? Not by being stupid. No law

has ever been written that didn't have a loophole in it. The rich can afford to lobby

Congress to get those loopholes created. And the rich can afford to hire people smart enough

to find and appropriate those loopholes. What makes matters worse is that not only do the

rich get richer, but those whose job it is to redistribute the wealth gain power and use that power

to get even richer themselves. So, the poor will always be with us.

Biden

Spokesman Jean-Pierre: Gas [and] Food Prices [are] Down. Data: No, They

Aren't. In the real world where Americans live, gas, food, and other consumer prices

have risen dramatically since President Joe Biden took office. Prices at the grocery store

are out of sight. Filling the gas tank practically requires a second mortgage. And

forget buying a home at today's prices and mortgage interest rates. Apartment rents are

zooming. But in Biden World, all is well. Or so says spokesman Karine Jean-Pierre:

In Biden World, gas and food prices are "down," all thanks to Biden, of course.

Inflation

May Have Been Much Higher Than We Thought. Former Secretary of the Treasury Larry

Summers put together a Twitter thread back in February which was widely ignored. In his

comments, Summers makes an argument that increasing interest rates drastically accelerated the true

inflation rate experienced by an average citizen. He specifically calls out this increased

inflation was missed by the current CPI measurement. [...] The former Secretary of the Treasury was

not looking to simply complain though. He and his colleagues created a new methodology to

calculate CPI in an attempt to get closer to the truth about what has been going on.

Retail

sales rise by paltry 0.1% as shoppers feel pinch of high inflation. Retail sales

barely rose last month as Americans burdened by persistently sticky rates of inflation increasingly

pull back on spending. Data released on Tuesday by the Commerce Department showed that the

value of retail purchases rose 0.1% in May — below analyst estimates of 0.2%.

Retail sales for the previous month were revised downward to 0.2%.

The Editor says...

Lots of information about inflation and unemployment is quietly revised a few weeks after it is

first published, but the revised (worse) numbers don't make headlines.

A

Slate writer gaslights about the allegedly great Biden economy. Zachary Carter,

writing for hard-left Slate, has issued his verdict on the economy: It's great. Wholly

contrary to popular belief, he assures us, "Inflation Is Not Destroying Joe Biden." So why

can't the rest of America see it? 'Tis a mystery to be solved, and he buries us under "data"

to make his point. Ultimately, his piece is a primal scream of horror that Americans insist

on believing the realities of their wallets over the cherry-picked data in his analysis.

First, Carter first declares that inflation is a thing of the past. "According to the Federal

Reserve's preferred measure, prices rose just 2.7 percent between April of 2023 and April of

2024." The problem with the Fed is that its "core" inflation number excludes the cost of

food, housing, and energy — the things that average Americans spend the vast majority of

their income purchasing.

Prices

Are Never Going Down. Biden tells us he's fighting inflation, and it seems as if we

hear every day in the news about the Fed leaving interest rates unchanged to fight inflation.

But prices are still high and rising. The latest numbers just released show that prices year

to date are still rising faster than expected. It's true that two years ago, inflation peaked

at around 9%, and today, it's hovering in the mid-3s. So why haven't prices come down?

It's a common misconception, often fueled by the crowd on the left alleging corporate greed, but

inflation isn't the price level — it's the rate of increase in prices. A reduction

from 9% to 3% doesn't mean that prices should come down 6%; it means that now they will go up at

3%. Corporations may be greedy, but that has nothing to do with the inflation rate. The

government, on the other hand, plays a significant role in managing inflation and deflation through

its monetary and fiscal policies.

The Editor says...

The price of groceries may never go down, but the price of gasoline will go down quite a bit as soon as Donald Trump

or some other future President opens up petroleum production on all areas of the U.S., and removes senseless

restrictions on the refining and transportation of oil.

Private

Enterprise Is the Victim, Not the Perpetrator, of Inflation. There was a nice deli

down the street I had never visited so I made a casual visit. They have been around for many

decades, a local favorite. Looking for a menu, there were printed ones but the prices were

all scratched out. The owner pointed up to a chalkboard on which they write prices of the

day. The printed menus from 18 months ago had sandwiches at $9. The chalkboard that day

had them at $15 and higher. I noted the difference to the owner. There was deep pain in

his face. He could not afford to reprint menus so the chalkboard is the only way to keep up

with rising prices. He clearly felt awful about this but margins are very tight.

Raising prices was necessary in order to keep the business in the black. This is because the

prices of absolutely everything have gone through the roof, from ingredients to transportation to

utilities and rent to labor (he has to retain employees and compete in a market of limited supply)

to insurance and repairs.

In

the best economy ever, 78% of Americans see fast food as a "luxury". In research

conducted by Lending Tree, Americans were asked about their food choices, and if you've been living

outside the rose-colored windows of the White House and Wall Street, the results are not at all

surprising. [...] Nearly half (46%) say fast-food restaurants cost similarly to their local

sit-down restaurants, while 22% say fast food is more expensive.

Quantitative

Brainwashing. We're all familiar with the term, "quantitative easing." [...] When QE

was implemented, the purchasing power was weak and both government and personal debt had become so

great that further borrowing would not solve the problem; it would only postpone it and, in the

end, exacerbate it. Effectively, QE is not a solution to an economic problem, it's a bonus of

epic proportions, given to banks by governments, at the expense of the taxpayer. But, of

course, we shouldn't be surprised that governments have passed off a massive redistribution of

wealth from the taxpayer to their pals in the banking sector with such clever terms.

Governments of today have become extremely adept at creating euphemisms for their misdeeds in order

to pull the wool over the eyes of the populace. At this point, we cannot turn on the daily

news without being fed a full meal of carefully-worded mumbo jumbo, designed to further overwhelm

whatever small voices of truth may be out there.

If

the Dems ditch Biden, what then? [Scroll down] More myths are likely to

spring from the debates, since actual transcripts will fail to invoke the true meaning of what was

said and implied. For starters, I expect Biden to strenuously deny the seriousness of

inflation. He will, again, blame greedy corporate price-gougers — as if there were

really no such thing as competition among businesses for customers. He will also point to the

Dow going above 40,000 for the first time. However, using the online inflation calculator, a

Dow at 40,000 today would drop down to 32,900 if it were expressed in January 2020

dollars. That really wasn't all that long ago.

Has

America Finally Had It With Joe Biden? Joe Biden's personal approval rating is at

historic lows; almost all his policies do not poll fifty percent. He is behind Trump in

almost all the swing states. And now he lies serially even to sympathetic interviewers.

In short, finally Biden has been exposed for what he always was and represented. [...] Biden just

told his greatest whopper that inflation was at 9 percent (actually 1.4 percent) when he

took office and yet soon spiked to 9 percent due to his reckless deficit spending and money

printing spree.

GenZ

Is Furious About the Economy and They Are Blaming Previous Generations for Wrecking

It. No matter how hard they work, millions of Gen Z Americans are just barely

scraping by month after month, and many of them are seriously [angry] about it. In fact,

videos of Gen Z Americans ranting about the economy on TikTok have been racking up millions of

views. Many of those that are ranting about the economy absolutely hate the fact that no

matter how much they try they can never seem to get ahead. Others just keep getting deeper

and deeper in debt because they can never seem to make enough money to pay all the bills. And

do you know who they are blaming for the pain that they are experiencing? They are blaming

those that belong to previous generations for wrecking the economy, and they are right.

The Editor says...

You wrecked the economy, boo hoo, but please forgive my student loans, and don't

stop sending money to Ukraine, and finish that high-speed rail line, and shut down all the

coal-fired power plants, and don't lock up shoplifters because they're just trying to feed their

families, and build a new stadium for our football team, and keep bringing in more deadbeats from

Mexico and giving them free stuff. But how dare you wreck the economy!

Behind

The Inexplicable "Strength" Of US Consumers Is $700 Billion In "Phantom Debt".

Yesterday we discussed the latest consumer credit data, which revealed that the amount of credit

card debt across the US has hit a new record high of $1.337 trillion (even though it appears

to have finally hit a brick wall, barely rising in March by the smallest amount since the covid

crash), even as the savings rate has tumbled to an all time low. [Chart] To be sure, credit

card debt is just a small portion (~6%) of the total household debt stack: as the next chart from

the latest NY Fed consumer credit report shows, the bulk, or 70%, of US household debt is in the

form of mortgages, followed by student loans, auto loans, credit card debt, home equity credit and

various other forms. Altogether, the total is a massive $17.5 trillion in total

household debt. [Video clip]

This

Economy Does Not Look Good. Core inflation rose at a 3.8 percent annual rate in

the first quarter and 2.9 percent in March, the Commerce Department reports. Fearful of

renewed inflation, the Federal Reserve will not ease up on the money supply and will keep interest

rates at their highest level in more than two decades, as Fed Chairman Jerome Powell announced on

Wednesday, which should slow economic growth further. Meanwhile, President Biden is doing his

very best to destroy the economy via regulatory brutality. The American Action Forum reports

that Biden "agencies published $875.3 billion in total costs" on the U.S. economy in just

one week in mid-April, including tighter emission standards for cars, tougher efficiency

requirements for light bulbs, and silica exposure limits clearly meant to end coal mining.

Biden's one-week regulatory bacchanal amounted to "[j]ust $20 billion less than what President

Obama did in two terms!" notes AAF President Douglas Holtz-Eakin. The contrast between Biden

and Trump is ten times as dramatic as that: $1.37 trillion by Biden to $30.1 billion by

Trump by April of year four of their respective administrations.

The

economic indicators' used by the media elite. David Chalian, political director for

CNN, can't understand for the life of him why the economy is still "front and center" for most

Americans, because there are other things that Joe Biden "performs worse on." (Are there

though?) On a recent CNN segment, Chalian was caught scoffing at the stupid rubes ("Americans")

who "disapprove" of Biden's handling of the economy, because these uneducated flyover saps pay more

attention to how they're feeling rather than the "economic indicators and data" that all the media

elite "report on constantly." [Tweet with video clip] [...] Those "feelings" that Chalian's

talking about aren't really feelings, but legitimate indicators of where the economy is, and ones

with which we interact constantly; here are just a few examples: [...]

Joe

Biden says things, and then there's reality. If I were advising Biden, I would also

tell him to stop pretending his policies have brought inflation down. Joe also claims that

his policies have significantly brought down inflation. Maybe statistically, but average

people's inflation is still way up. The poor, the middle class, and seniors on fixed income

are being decimated by the price of necessities that have skyrocketed due to Biden's policies,

especially on energy. For example, I received my homeowner's insurance bill this week.

It is up over 15% from last year. I have never had a claim, have an excellent credit score,

and have a $2,000 deductible along with a 10% deductible on earthquake insurance. We built

our house 36 years ago, and in Springfield, Illinois, the value has increased only one or two

percent per year, at most. It sure doesn't help to live in the state with the second highest

property tax rate in the country.

The